In July 2024, the cryptocurrency world was rocked by one of the most significant security breaches to date, targeting India’s largest cryptocurrency exchange, WazirX. The hack, resulting in the theft of approximately $230 million in various cryptocurrencies, has highlighted crucial vulnerabilities within the crypto ecosystem. Here at Frontal, we aim to dissect the incident to understand what transpired and the key lessons that can be drawn to enhance Web3 security practices.

What Happened?

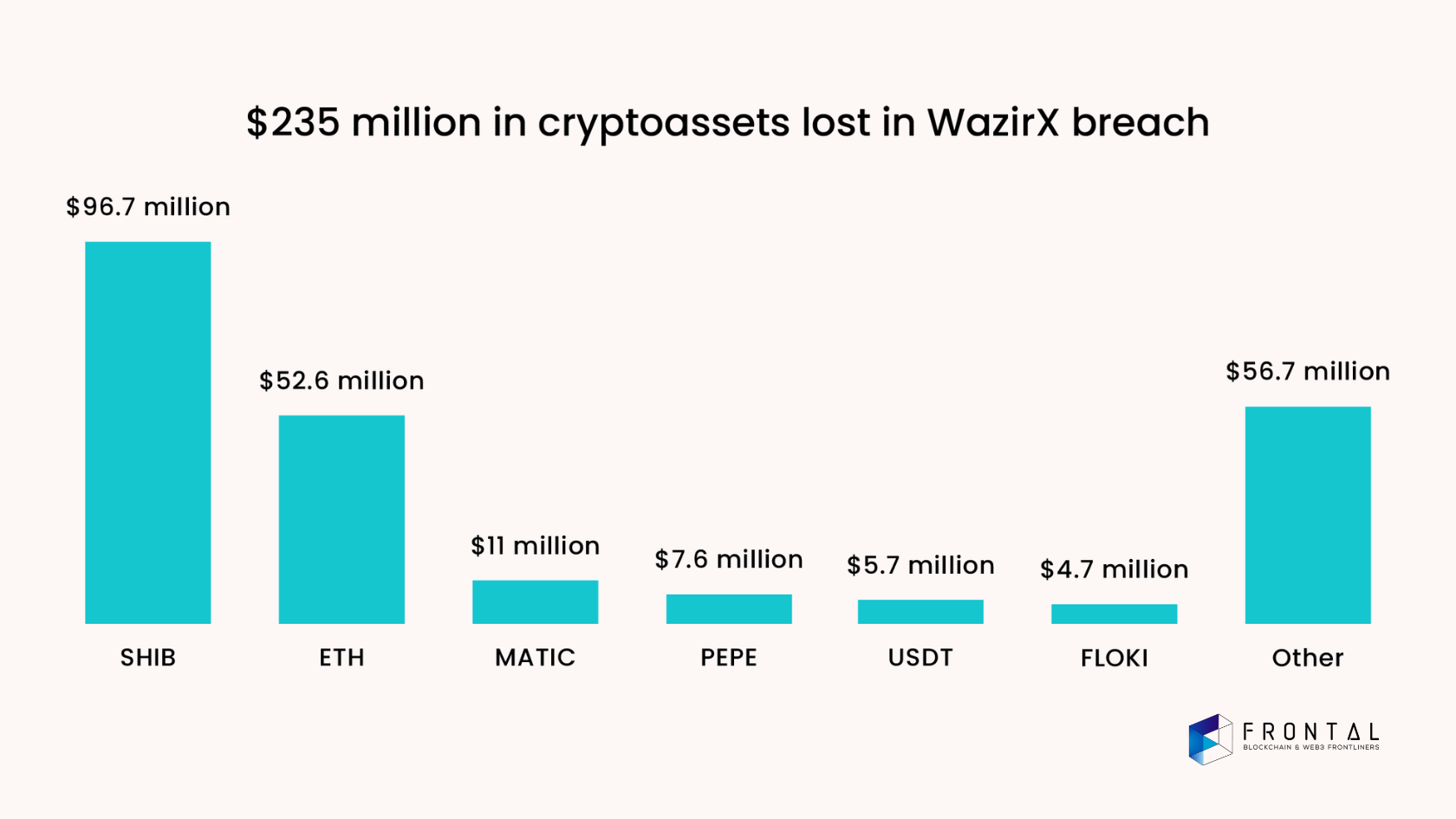

1. The Scale of the Breach: WazirX experienced an unprecedented attack, losing around $230 million worth of assets. This included significant amounts of SHIB, ETH, MATIC, PEPE, USDT, and GALA. The breach targeted WazirX’s multisig Ethereum wallet, which is designed to require multiple signatures to execute a transaction, theoretically adding an extra layer of security.

2. Method of the Attack: The attacker exploited a vulnerability in the wallet’s infrastructure. By creating a mismatch between the information displayed on the interface and what was actually signed, the hacker tricked the system into approving unauthorized transactions. This method allowed the hacker to gain control over the wallet and initiate the transfer of assets.

3. Immediate Response: Upon detection of the breach, WazirX swiftly suspended all cryptocurrency and INR withdrawals to prevent further losses. Despite these efforts, the hacker had already started liquidating the stolen assets. This rapid response, while necessary, also impacted users’ ability to access their funds during the critical period following the hack.

4. Attribution to North Korean Hackers: Investigations led by blockchain analytics firms like Elliptic and CryptoQuant attributed the attack to North Korean hackers, specifically the Lazarus Group. This group is notorious for its sophisticated cybercrimes, often targeting financial institutions and cryptocurrency platforms worldwide. Their involvement underscores the increasing sophistication of threats facing the crypto industry.

Lessons Learned

1. Importance of Regular Security Audits: This incident underscores the critical need for regular security audits and updates. Ensuring that all components of a crypto platform are up-to-date and secure can prevent many vulnerabilities from being exploited. Continuous monitoring and timely audits are essential to maintaining the integrity of digital asset infrastructures.

2. Enhanced Multi-Factor Authentication (MFA): While multisig wallets add a layer of security, they are not foolproof. Implementing multi-factor authentication (MFA) for all transactions can provide an additional safeguard. This could include biometric verification, hardware tokens, or other advanced MFA techniques to ensure that only authorized transactions are approved.

3. Improved User Education and Awareness: User education is paramount in preventing security breaches. Ensuring that all users, from the platform administrators to the end-users, understand the importance of security measures and how to recognize potential threats can significantly reduce the risk of successful attacks.

4. Regulatory and Compliance Standards: The WazirX hack highlights the necessity for stricter regulatory standards within the cryptocurrency industry. Governments and regulatory bodies need to establish comprehensive guidelines to protect investors and ensure that exchanges adhere to best practices in security and risk management.

5. Advanced Threat Detection Systems: Investing in advanced threat detection and response systems is crucial. These systems can help identify unusual activities and potential breaches in real-time, allowing for quicker responses to mitigate the impact of an attack. Utilizing machine learning and AI-driven analytics can enhance the effectiveness of these systems.

6. Decentralized Security Solutions: Exploring decentralized security solutions can provide additional layers of protection. By leveraging the inherent security advantages of decentralized networks, platforms can distribute the risk and make it more challenging for attackers to compromise the entire system.

Conclusion

The WazirX hack serves as a stark reminder of the evolving threats facing the cryptocurrency industry. It is a call to action for all stakeholders to prioritize security and implement robust measures to protect digital assets. At Frontal, we are dedicated to advancing Web3 security through continuous innovation and education. By learning from incidents like the WazirX hack, we can build a safer, more resilient crypto ecosystem for the future.

For more insights on Web3 security and how you can protect your digital assets, stay tuned to our blog and follow us on our social media channels. Let’s work together to fortify the future of decentralized finance.