In September 2023, the crypto world was shaken by one of the most significant DeFi hacks of the year when the Mixin Network fell victim to a devastating breach. This security incident resulted in losses estimated at a staggering $200 million. In this blog post, we will delve into the technical details of the Mixin Network hack, its aftermath, and the lessons learned from this high-profile attack.

The Breach Unveiled

The Mixin Network hack was an audacious breach that targeted the organization’s cloud service provider. The attacker successfully compromised the database of this service provider, granting them unauthorized access to the Mixin Network’s hot wallets.

The consequences were dire as the attacker managed to drain approximately $200 million from the decentralized peer-to-peer network. To add intrigue to the story, one of the wallets involved in the attack had previously received 5 ETH from the network.

Mixin Network’s response to the breach included the promise of a livestream scheduled for September 25th, aimed at providing a detailed explanation of the incident. However, the links to the livestream were not publicly shared, leaving the community in suspense regarding its actual occurrence.

Response and the Stolen Funds

In the aftermath of the attack, Mixin Network’s founder announced a compensation plan to alleviate the impact on affected users. Initially, the plan included a 50% refund of users’ assets, offering some hope for those who suffered losses.

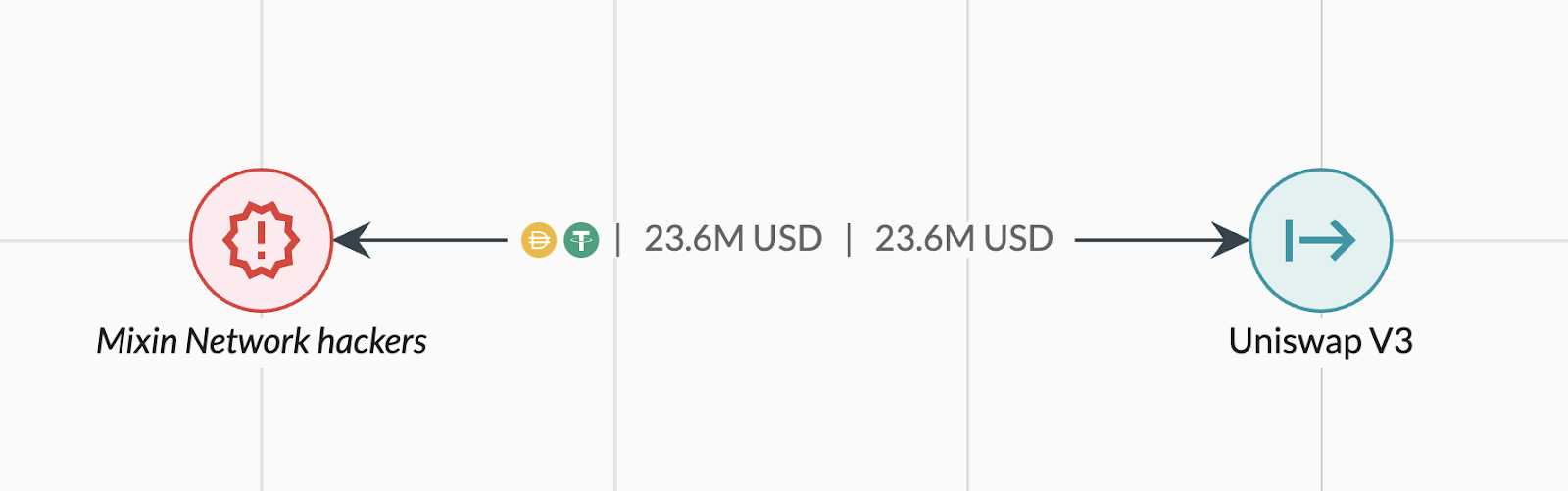

An analysis of publicly-shared exploiter addresses revealed that the stolen funds comprised $95.3 million in Ether (ETH), $23.7 million in Bitcoin (BTC), and $23.6 million in Tether (USDT). This analysis revealed a startling fact: Hackers had gained control of 9% of Mixin’s BTC, 71% of its ETH, and a staggering 93% of its USDT holdings.

Laundering Attempts and Cross-Chain Crime

Hackers behind the Mixin Network breach wasted no time in attempting to launder the stolen funds. They used a decentralized exchange to convert USDT into Dai stablecoin. Unlike USDT, Dai cannot be frozen, making it a preferred choice for cybercriminals looking to cover their tracks. This technique is in line with the laundering typology discussed in reports, highlighting the increasing exploitation of decentralized exchanges and other decentralized anonymous exchange protocols.

Key Takeaways

The Mixin Network hack serves as a stark reminder of the critical importance of safeguarding cryptocurrency assets. The breach of the organization’s cloud service provider’s database paved the way for the attacker to exploit vulnerabilities in the project’s hot wallets. This incident underscores the need for robust security measures, including the use of cold wallets, to protect crypto assets effectively.

Conclusion

The Mixin Network hack of 2023 serves as a stark reminder of the constant threats faced by the crypto industry. As the world of DeFi continues to evolve, security measures must be continually strengthened to protect valuable assets. Mixin Network’s response, alongside the analysis, sheds light on the evolving landscape of crypto-related crime, emphasizing the need for vigilance and proactive measures to safeguard the crypto community from such devastating breaches.